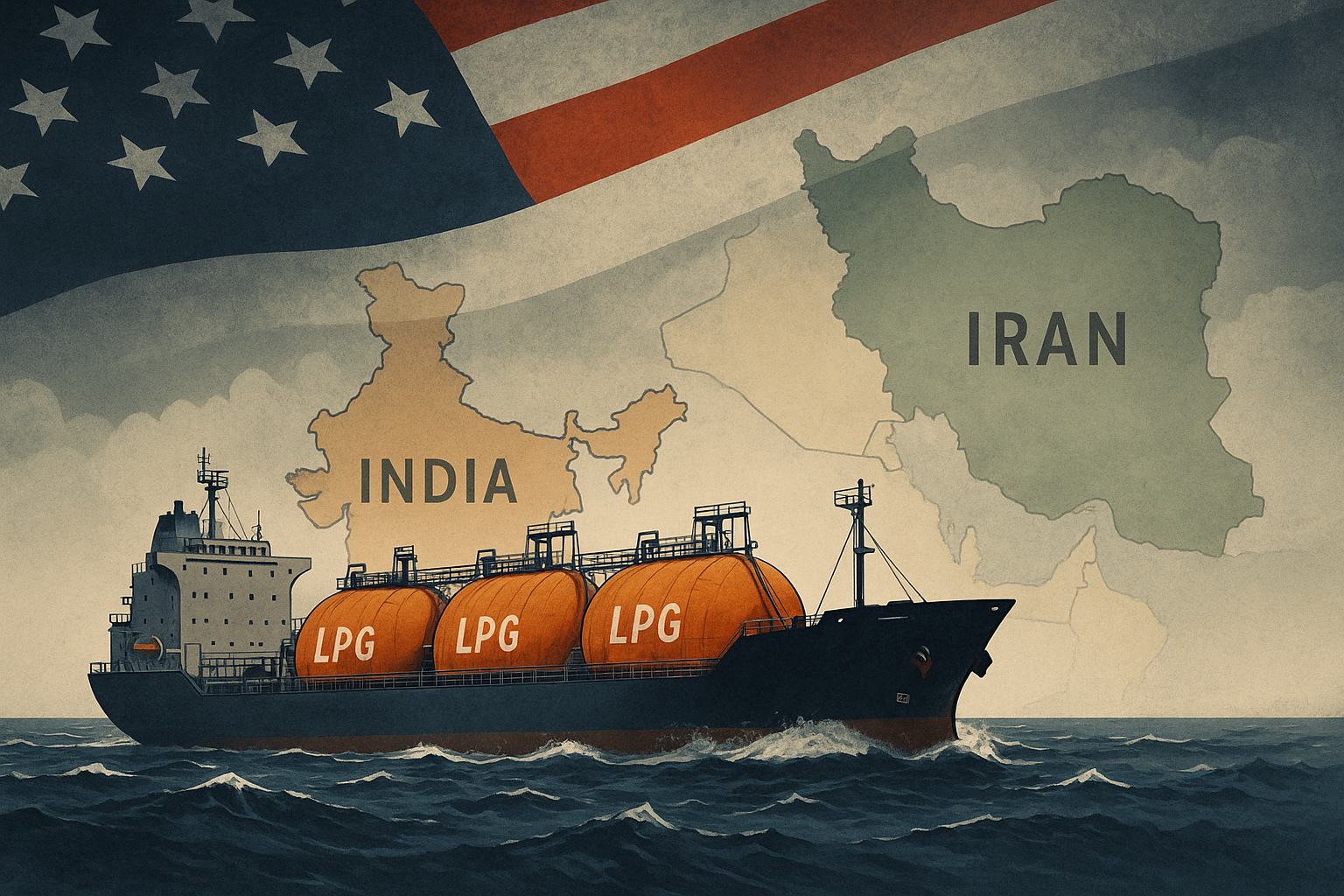

The Adani Group, one of India’s largest conglomerates, is reportedly under the spotlight of U.S. regulators following allegations of involvement in LPG shipments connected to Iran. This scrutiny stems from possible violations of U.S. sanctions that restrict business dealings with Iranian state-owned entities.

Background: Why Iran LPG Matters

Iran is one of the world’s leading producers of oil and gas. Despite being rich in natural resources, Iran faces significant global restrictions, particularly from the U.S., due to its nuclear program and other geopolitical concerns. LPG (liquefied petroleum gas) is one of Iran’s key exports, and the U.S. has tightened oversight on entities indirectly helping Tehran monetize this resource.

U.S. Sanctions and Their Implications

U.S. sanctions prohibit companies and individuals from engaging in commercial activities with Iranian state-owned enterprises, including oil and gas transactions. Even indirect involvement — such as transporting, financing, or insuring sanctioned goods — can draw penalties. This makes the U.S. especially vigilant about any dealings with Iranian LPG.

What Is Adani Allegedly Involved In?

According to investigative reports, certain vessels linked to Adani may have been involved in transporting LPG cargoes that originated from or passed through Iran. While there is no confirmed evidence that Adani directly violated sanctions, the possibility of indirect links has raised red flags in Washington.

Geopolitical and Economic Repercussions

This issue goes beyond corporate risk. If the allegations are substantiated, it could trigger diplomatic tensions between India and the United States. It could also lead to tighter scrutiny of Indian conglomerates involved in the global energy trade.Additionally, financial institutions working with Adani might face secondary sanctions if found to be indirectly supporting sanctioned activities.

Adani’s Response and Public Statement

As of now, the Adani Group has strongly denied any wrongdoing. In a press release, the company stated:>

“Adani Group strictly complies with all international laws and sanctions and has never knowingly engaged in business that violates U.S. or other global sanctions.”The group has pledged full cooperation with any inquiries and emphasized its commitment to regulatory compliance.

The group has pledged full cooperation with any inquiries and emphasized its commitment to regulatory compliance.

Industry Reaction and Market Impact

The news has sparked reactions across the global commodities and shipping sectors. Experts say the development could lead to stricter due diligence requirements for Indian energy players. Stock market analysts are also watching closely to see if Adani’s shares will be affected.

If this scrutiny escalates into formal action, it could affect financing and international partnerships for Adani’s ports, logistics, and energy businesses.

What Comes Next?

U.S. regulators may take weeks or months to complete the review process. Meanwhile, Adani may face reputational damage regardless of the outcome. Global companies operating in sensitive sectors are expected to enhance their compliance protocols to avoid similar scrutiny.

Legal experts suggest that if violations are proven, penalties could range from fines to exclusion from U.S. financial systems — although such outcomes are considered extreme and rare.

Final Thoughts

The Adani-Iran LPG story highlights the fragile balance between global trade, energy security, and international law. As the situation unfolds, it will serve as a reminder to multinational corporations that compliance isn’t optional — it’s essential. Whether Adani is cleared or penalized, this incident underscores how geopolitical complexities increasingly shape global business.

Hi